In the second season of Phoebe Waller-Bridge’s masterpiece Fleabag, a woman called Belinda, played by Kristin Scott Thomas, wins a “Best Woman in Business” award. After seemingly gracefully accepting the award, however, she reveals her true, begrudging thoughts to Fleabag in a more intimate setting. This is what she has to say:

“It’s infantilising bollocks… It’s ghettoising. It’s a subsection of success. It’s the … children’s table of awards."

And her anger is righteous - why not get a “Best Person in Business” award? Why are women still so often jumbled together in due solely to our gender, as if we couldn’t play in the big leagues?

But you could grow suspicious that we are doing the very same thing there. Why are we talking about women-led startups as a single category? Does it feel like it’s another case of generalizing based on gender? Is that what an entire identity boils down to?

Of course it does not, and we certainly don’t mean to do that. But the truth is that women still face shared obstacles in the world - in this case, the world of business - due to their gender. This March 8, we wish to pay special attention to the obstacles women face in business and the startup ecosystem.

We will try to relay the cold, hard analytics behind women’s stories in the startup world - what barriers stand in the way and how women are crushing them. In the end, you’ll find that investing in the top women-led startups is nothing short of good business.

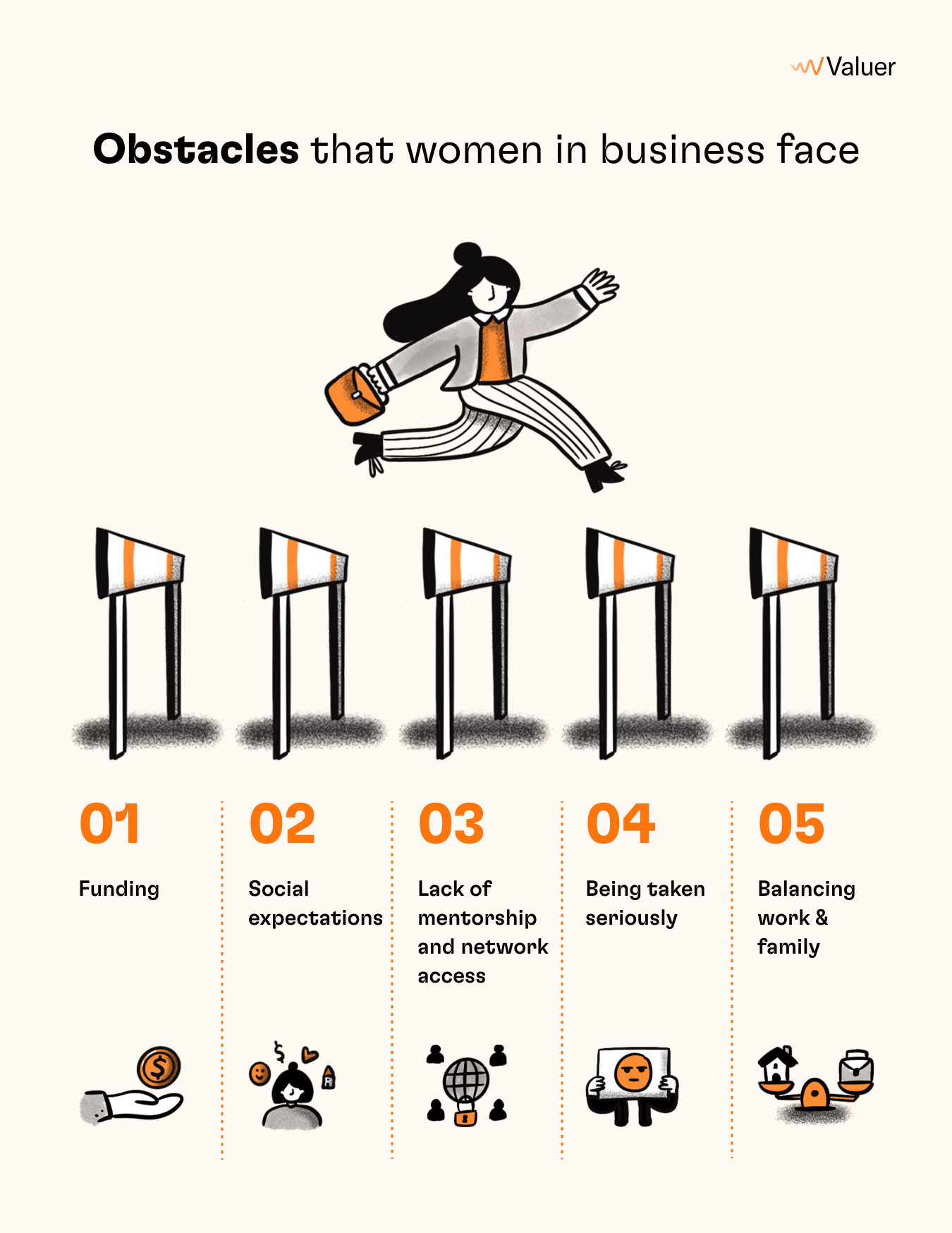

The obstacles for businesswomen

“Female” is still often used as a modifying adjective in the world. There’s CEOs and then there’s female CEOs, there’s presidents and then there’s female presidents, there’s directors and then there’s female directors. This indicates that the idea that gender doesn’t matter is not yet ingrained in the collective mindset.

What truly matters is to encourage diversity and equal opportunities to marginalized groups rather than to continue treating them as rare pokemon. And while some things improve - 31% of small business and franchise owners in the US were women in 2021, an increase from 27% in 2020 - they are still in the minority.

[Related Article - Top 34 Women-led Startups in 2022]

For instance, one out of five firms with a revenue of over $1 million is woman-owned. So, what are some obstacles women founders and women CEOs face?

Female CEOs told Business News Daily that one of the unique obstacles they face due to their gender is being expected to take on a “male” attitude to business, i.e., be competitive and aggressive. However, correspondents said that they prefer tailoring the task to their own approach values, which eventually yields success. Incidentally, there’s an interesting theory in a book called Blue Ocean Strategy that talks about creating unique businesses in untapped markets rather than engaging in the existing cutthroat business culture.

Though all businesses suffered during the pandemic, this was especially the case for female founders. In 2020 saw a dramatic decrease in funding for women-led startups. And incidentally, it’s not like everyone’s business suffered equally - the proportion of “dollars to female-only founders” dropped down to 2.3% from 2019’s 2.8%. And even before the pandemic, there was a drop in funding for startups with at least one woman co-founder, from 17% in 2018 to 12% in 2019. What’s more, more research found that women founders raise 38% less than men under the same conditions. Essentially, this puts women about 5 years behind their male counterparts.

Bonnie Crater, CEO of Full Circle Insights, shared that VCs are more likely to invest in a demographic similar to their own, so VC firms with female partners are more likely to invest in women-led startups. Sadly, reports show that that’s only 6% of VC firms. On the other hand, new studies found there’s been a staggering 50% increase in women investors in 2021 from 2018. More women investors means more women getting invested in.

Another potential reason as to why women CEOs get less funding is that they are less likely to overstate their projections and provide more realistic numbers, according to Gloria Kolb, CEO and co-founder of Elidah.

Women have great ideas and products, however, the difficulty of finding the right mentors or network in a male-dominated business world can limit their professional growth. Nearly half of the respondents to a survey - which were women founders - cited “lack of available mentors or sponsors” as a roadblock.

A Swedish qualitative study suggests that venture capitalists are biased when making a decision on funding women entrepreneurs. When they collected performance data from both male and female entrepreneurs, they concluded that the discriminatory beliefs of VCs regarding women entrepreneurs were unsubstantiated, as there’s no difference in performance between the sexes.

- Balancing business & family life -

Generally, entrepreneurs don't start a venture until they reach their 30s, around the same time that women start a family, and balancing both roles is a demanding task. And although it seems like we’re making great strides in gender equality, some things have remained virtually unchanged for a quarter of a century.

According to the Pew Research Center, from 1989 to 2016, the number of stay-at-home dads rose from 4% to only 7%, while the number of stay-at-home moms remained quite similar - it was 28% in 1989, and it was 27% in 2016. Overall, 10% of stay-at-home parents in 1989 were dads, and that number rose to 17% in 2016, which means that 83% of stay-at-home parents the same year were mothers.

What’s more, a 2020 McKinsey report found that COVID has affected the number of working mothers. Up to 30% of mothers were considering leaving the workplace. Sadly, this comes as no surprise, as much of the workload at home - especially when there’s children in the picture - often falls upon women’s shoulders. The “double-shift” of working mothers - i.e., taking care of home and family after they’re finished work - increased during the pandemic. When you put all this together, you’ve got a grand recipe for burnout.

Why you should invest in women-led startups

The female population is under-represented in the startup ecosystem since about one-fifth, or 20% of startups have at least one female founder globally. Still, this is an increase from 17% in 2017. What’s more, data shows that only 15.5% of entrepreneurs in Europe are women.

Businesswomen are often overlooked as there is often a subconscious bias in that women will not be as reliable an investment as opposed to a male counterpart. However, data shows that investing in a female-led startup is promising and here's why:

- Performance data compiled over 10 years by First Round Capital showed that investment in a startup with at least one female founder outperformed all-male founding teams by 63 percent.

- Kevin O'Leary noticed a pattern in his portfolio while doing the year-end audit. All of his returns came from companies either owned or run by women. The female-led startups with sales between $5M and $300M made up to 52 percent of his private portfolio.

- According to research by Boston Consulting Group, startups co-founded by women are noticeably better financial investments. For every dollar of funding, a female-led startup gives on average 78 cents back whilst male-founded startups generate a lot less than that - just 31 cents. Other findings support this - women-led startups yield twice as much as the invested dollar, companies with female leadership have a higher return on equity by nearly 3%, and finally, Fortune 1000 companies with female CEOs saw returns that were 226% higher.

- It is estimated that on average, women-led companies grow by 84%, while male-run companies in comparison grow by 78% from their start date. This is despite the fact that women receive less funding.

- Women entrepreneurs are more capital-efficient as they bring in 20 percent more revenue than their male counterparts with half of the money, according to the Kauffman Foundation.

- A cross-national study on the motivation of women entrepreneurs found that although there were variations by region, established economies are pursuing “business opportunities to satisfy social needs, rather than focusing on traditional business outcomes such as growth or profit.” Though, according to other data, there’s no shortage of the latter either.

- Beyond operational efficiency, research finds that women better understand unsatisfied demands, which present massive market opportunities. This goes back to the blue ocean strategy - rather than joining in heavy competition, it’s about discovering untapped markets. And what’s more, when more women scale up, more women start up.

In other words, the market makes female-led startups a promising opportunity to invest in as they are less competitive and, on average, generate more revenue. The takeaway is not that "women are a better bet than men," rather, it’s that women entrepreneurs tend to work twice as hard to show their capability and secure themselves a space in the business world. Which in itself shows how discrimination has a funny way of tipping the scales.

Investing in women is investing in the future

We already saw that women are more aware of untapped markets - after all, women had been an underserved demographic for a long time. What this translates into today is a host of innovative, disruptive solutions to all sorts of problems, old and new. For instance, Trish Gillian of the Plastics Circle told us in an interview that by solving the problem of plastic through an economy-driven model rather than solely an environmental one, they are disrupting the status quo and the corporate approach to plastic as waste.

Although the pandemic presented a setback, 2022 will be a year of growth for many women entrepreneurs. Despite adversity, they have been raising money, attracting customers, and expanding their businesses. Female-led startups are slowly but surely taking over the world, showing us that successful businesswomen have the power to change the game.

Above all, when we say that “investing in women is investing in the future” we mean that the day that accomplishments are judged for their value and not for the person who created them will be a monumental one for humanity. Women shouldn’t have to keep proving their worth - it’s a won argument that’s come out of centuries of toil and turmoil, and we will always have March 8th to remind us of that.

Above all, when we say that “investing in women is investing in the future” we mean that the day that accomplishments are judged for their value and not for the person who created them will be a monumental one for humanity. Women shouldn’t have to keep proving their worth - it’s a won argument that’s come out of centuries of toil and turmoil, and we will always have March 8th to remind us of that.

.png?width=103&height=103&name=Untitled_Artwork%20725%20(2).png)